Ignite Your Independence

as an IT Consultant

Free yourself from the burden of back office administrative duties, payroll processing, tax compliance concerns, and legal tasks…and launch your career as an Independent IT Consultant with PCSx.

Problems We Solve

Leap Into Independent IT Contracting Confidently

Retain your healthcare coverage when moving between contracts.

PCSx will ensure that you are protected against claims of negligence, errors, or omissions that result in financial losses for clients.

Focus on being an IT contractor, not an accountant, filing tax forms and processing payroll.

Payroll is managed; you don’t have to complete W2 forms, ensure compliance, or find a payroll vendor to do it for you.

Unlike consulting firms, freely search for contracting jobs that interest you with our list of vetted companies at your disposal.

Get paid without worries. Our payroll and accounting staff will ensure you get paid on time and adhere to all tax compliance requirements.

The Benefits are Worth Exploring

If you’ve worked as a full-time employee most of your career, but wondered what Independent Contracting would be like, it’s a great time to take the leap.

Turn curiosity into action.

We are here to ease the way to ignite your independence from full-time to contracting by providing all the back-office support necessary to take the leap into IT consulting.

That’s why PCSx was formed.

Administrative Services

Back Office Headaches Managed for Independent IT Contractors

Independent IT contracting with PCSx liberates you from corporate control. It empowers you to chart your professional path, negotiate better pay rates, choose clients and projects you enjoy, gain experience in various styles and technologies, and work locally or travel—it’s your choice!

But there’s still the burden of payroll, taxes, insurance, and benefits that come with being new at IT Consulting or a 1099 employee.

Our administrative services make your transition into independent contracting simple by taking the administrative tasks off your plate with our comprehensive back-office support and services.

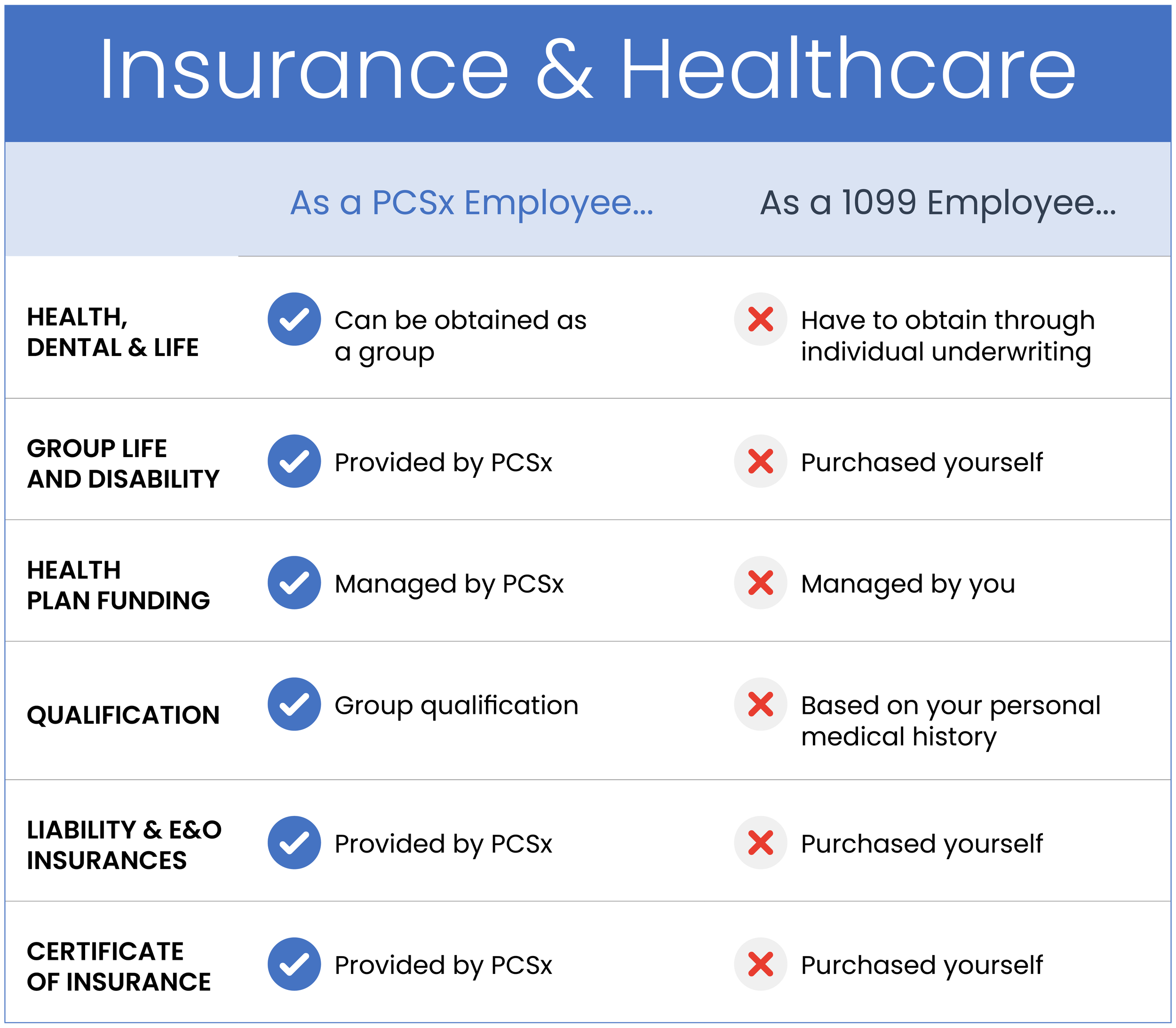

Compare the pros and cons of working for PCSx versus on your own as a 1099 contractor:

Benefits

Secure Health Insurance and Maintain Benefits as an Independent Contractor

Bench with Benefits Program

With PCSx, you can freely move from contract to contract without losing coverage, having to secure coverage yourself, or dealing with the hassle of re-enrollment.

With the Bench with Benefits Program, accrued benefits continue as you go from one project to another.

The PCSx Process

Streamlined Contracting Process for Independent IT Professionals

Project Search →

You find and choose your own contract opportunities.

PCSx is available to assist with your search for your next contract opportunity if needed.

You join PCSx as

a W2 employee on the first day of your project.

Finalize Project Details →

You finalize contract details, including pay rate, contract length, and more.

Then hand off the rest of the onboarding process to PCSx.

Backoffice necessities, such as the certificate of insurance, payroll processing, and more, are ready when you start your project.

Start Your Project →

After you begin your project, you will submit approved timesheets, and PCSx will complete the invoicing process when payment is received from the staffing firm.

You receive your wages as soon as the vendor submits payment to PCSx.

Focus on Your Project→

You work on your project with no worries.

When your contract ends, our bench with benefits program allows you to continue receiving health and other benefits between projects as you search for your next contract.

The PCSx Fee

The PCSx fee allows us to provide exceptional support and services for you to succeed

Over half of the fee percentage is used to pay for the mandatory employer payroll tax, which is a contribution to your Social Security and Medicare accounts.

The PCSx fee is a fixed percentage rate determined once the onboarding process begins. The fee percentage is calculated against the invoice amount once the staffing firm receives the payment. The remaining balance is your gross pay before the pre-tax medical payment (if applicable) and standard payroll taxes.

The Fee breakdown:

Employer Payroll Tax (Contribution to Employee’s Social Security and Medicare) ~ 7.8%

Workman’s Compensation ~ 1.4%

PCS Administrative remaining expenses ~ 5.8%

Example:

$9,600 ($120 p/h x 80 hrs)

- $1,440 (PCSx Fee: 15%)

$8,160 (Gross Pay before medical and taxes)

- $750 (Estimated medical payment – Pre-Tax)

$7,410 (Gross Pay before taxes)

$5,632 (Net Pay)

Annually 1,920 hrs, $120/h

Gross Pay before taxes: $175,340 (apprx)

Net Pay: $134,000 (apprx)

Your Independent Consulting Support Team

PCSx provides superior back office support and services that will motivate potential candidates to take that “leap” as an IT consultant without the back office worries that are normally inherited with independent contracting.

Why PCSx

Dedicated to Your Success as a Contractor

PCSx will provide IT consultants the opportunity and ability to do what they do best: use your unique technical skillset to provide exceptional IT consulting and support to your clients. As your support team, PCSx will manage, coordinate, and provide all the necessary back-office support for you, the IT professional, to succeed in the consulting industry.

We Are Here For You!

Similar to independent contracting but without the worries! You earn “contract” dollars without the hassle of processing payroll, federal, state, and local taxes, tax withholdings, accounting expenses, liability or insurance expenses, and other business expenses, and more.

PCSx is here to assist with your success!

Take the Leap Into Independent IT Contracting

Submit your information below.

Start Your Career as an Independent Contractor

Search for your ideal projects through staffing firms, negotiate your own pay rates, and work on your own time. When you need or want support, PCSx is here to assist in your search.

You’re Not Alone

Starting a new contract is intimidating with new colleagues, management styles, methodologies, and tools. We take some of the pressure off of you by being your support team for your back-office needs.